Importing from a third party piece of software

This assumes you have already set up the client in Sage Personal Tax.

- Export the data from your accounts production software. Do this from within the accounts production application you are using.

- Log in to Sage Personal Tax. The Client List window appears.

- Select the client to import the accounts data into.

- Click Select. Your client opens.

-

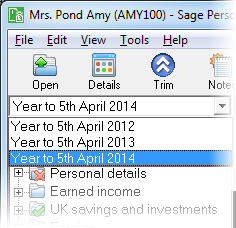

If the correct year isn't displayed, use the year drop-down list at the top of the navigator to choose the correct year. Show me.

- Using the navigator, open the Accounts Information page of the self-employment that the accounts data is to be used with.

-

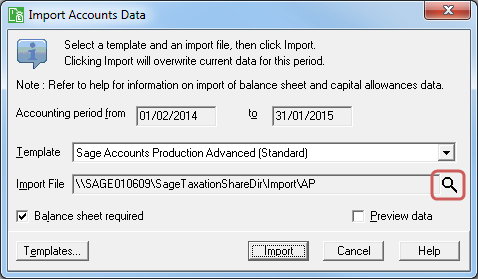

Click Accounts Import. You'll be warned that the import will first delete all data for the current accounting period. Click Yes to delete any data for the current accounting period. The Accounts Link window appears. Show me.

- Choose Sage Accounts Production Advanced (Standard) from the Template drop-down list.

- Click the magnifying glass icon to the right of the Import File box. An open file window appears.

- Use the window to find the file you exported from Sage APA and select it in the window.

- Click Open. The filename and path will be shown in the Import file box.

- Click Import to import the data. You will see the imported data in the Accounts Information section of the self employment.