Foreign pensions

Use this form to enter details about pensions or annuities that the client has received from outside the UK. Include pensions or annuities where the payer is in the UK but pays it on behalf of somebody else who is outside the UK.

Create a separate form for each foreign pension.

Foreign pensions are taxed as pension income (formerly under Schedule D, Case V).

Main Details

| Option | Description |

|---|---|

| Description | Enter a description of the particular pension. This description does not appear on the Tax Return - it only appears on the Annual Data Navigator. |

| Country code/name |

Enter the three-letter country code of the country from where the pension arose and in which tax has been deducted at source from that pension income. Click the finder button This is used in the Foreign supplementary pages (SA106). |

| Start date | Enter when the pension began, if known. |

| End date | Enter when the pension ended, if known. |

| Income is unremittable | Select this check box if the pension is unremittable. Clear the check box if it is not unremittable. Unremittable income is income arising outside the UK which the client was unable to transfer (or remit) to the UK because of exchange controls or a shortage of foreign currency in the overseas country. The client can claim that the unremittable income should not be taxable. |

| Claim tax credit relief |

Select the check box if the client is claiming foreign tax relief, or leave it clear if they are not. This will be disabled if the Income is unremittable check box is selected. If ‘Foreign tax’ needs to be restricted in the tax computation, amend the total Foreign tax credit relief claimed figure on the Foreign supplementary pages. |

| Amount before tax | The total gross amount of income from the pension in the currently selected tax year. This is the Amount before tax that is used in the Foreign supplementary pages (SA106). |

| UK tax | This is the UK tax amount that is used in the Foreign supplementary pages (SA106). |

| Foreign tax | Enter the total amount of Foreign tax that was charged on the pension in the currently selected tax year. Leave this box empty if no foreign tax was charged. This is the Foreign tax amount which is used in the Foreign supplementary pages (SA106). |

| Amount exempt | Enter the total gross amount of income from the pension in the currently selected tax year that is exempt from any tax. Leave this box empty if none of the income is exempt. See page F 7 of the notes for the Foreign supplementary pages (SA106) for a list of exempt pensions. |

| Amount chargeable | This default amount is determined by how much foreign tax has been paid, if foreign tax relief is being claimed and whether any of the income is exempt from foreign tax. This is the Amount chargeable that is used in the Foreign supplementary pages (SA106). |

How do I get here?

Foreign > Foreign pensions

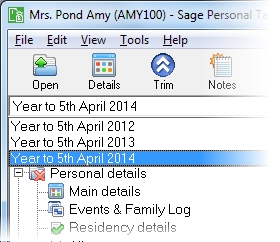

The tax year that you are entering details for is shown at the top of the data entry page. If you want to change the tax year, you should select a new date from the drop-down list at the top of the navigator.

-

Auto calc - If you tick this option, the calculations will be automatically completed for you where possible. If you untick this box you will see a new tab appear called Summary.

Note: Not all data-entry forms have an Auto calc option.

- Estimated - Tick this box to indicate that the figures you've used are estimated. This will then show on the item in the navigator, and at the higher level folder in the navigator by showing a small e.

- Complete - Tick this to indicate that the form is complete. A green tick will appear on the item in the navigator and at the higher level folder in the navigator.

If you want to close the page without saving any of your changes, you can click Cancel. If you were adding new details, then nothing will be saved. If you were editing an existing item then the page will close, reverting to your previously saved details.

if you don't know the code.

if you don't know the code.