State Retirement Pension

This section includes the following tabs. Click on a heading to find out more about the boxes on each tab.

| Option | Description |

|---|---|

| Description | A description of the pension. This description does not appear on the tax return. |

| Payment start date | Enter when the pension payments started if known. |

| Payment end date | Enter when the pension payments ended if known. |

| Payment frequency | Select a frequency from the options in the drop-down list. |

| Number |

This is the number of payments that the client is entitled to for the currently selected tax year based on the Payment frequency you've selected. For example, choosing Monthly as the Payment frequency will set this box to 12. You can change this default figure. |

| Individual | The gross amount of each payment that the client was entitled to, whether or not they actually received that amount in the tax year. |

| Total | The total gross amount for the currently selected tax year that the client was entitled to. It is the Number of payments multiplied by the Individual gross amounts. You can change this default amount. |

| Total (gross) | This is the overall gross total that the client was entitled to for the currently selected tax year. If you enter two payments the figure in the Gross total box is the sum of the Gross totals from Payments 1 and 2. This is the Taxable amount for the State Retirement Pension that is used in the Income section of the tax return. You can change this default amount. |

Taxable amount - This is the full amount of State Retirement Pension that the client was entitled to. This is used in the Income section of the tax return.

How do I get here?

Pensions and benefits > State pensions and benefits > State retirement pension

What's this page about?

Use this form to enter details about payments that the client was entitled to receive from any State pension.

Include:

- the basic (old age) pension, State earnings related pensions (SERPS).

- graduated pension (graduated retirement benefit).

- the age addition if you are over 80.

- any incapacity addition or addition for a dependent adult.

- any increases paid by the DSS to update a guaranteed minimum pension.

If the client received extra pension either because they deferred retirement beyond normal retirement age, or because they temporarily gave up their pension, the extra pension is taxable.

If the client is a married woman, include the pension payable to her, even if it was paid to her as a result of her husband's contributions.

Exclude any increase for a dependent child or the Christmas bonus for pensioners, as neither of these are taxable.

State Retirement Pensions are taxed as pension income (formerly taxed under Schedule E).

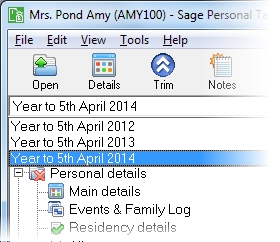

The tax year that you are entering details for is shown at the top of the data entry page. If you want to change the tax year, you should select a new date from the drop-down list at the top of the navigator.

-

Auto calc - If you tick this option, the calculations will be automatically completed for you where possible. If you untick this box you will see a new tab appear called Summary.

Note: Not all data-entry forms have an Auto calc option.

- Estimated - Tick this box to indicate that the figures you've used are estimated. This will then show on the item in the navigator, and at the higher level folder in the navigator by showing a small e.

- Complete - Tick this to indicate that the form is complete. A green tick will appear on the item in the navigator and at the higher level folder in the navigator.

If you want to close the page without saving any of your changes, you can click Cancel. If you were adding new details, then nothing will be saved. If you were editing an existing item then the page will close, reverting to your previously saved details.