Short life assets

This section includes the following tabs. Click on a heading to find out more about the boxes on each tab.

The transactions that should be entered are:

- Initial WDV B/Fwd - Initial Written Down Value, brought forward

- Purchase - Purchase of assets

- Sale - Sale of assets

- Scrap - Scrapping of assets

- OMV On Acquisition - Open market value acquisition

- OMV On Disposal - Open market value disposal

- Transfer to the main pool

For each transaction, you should enter a date and a value.

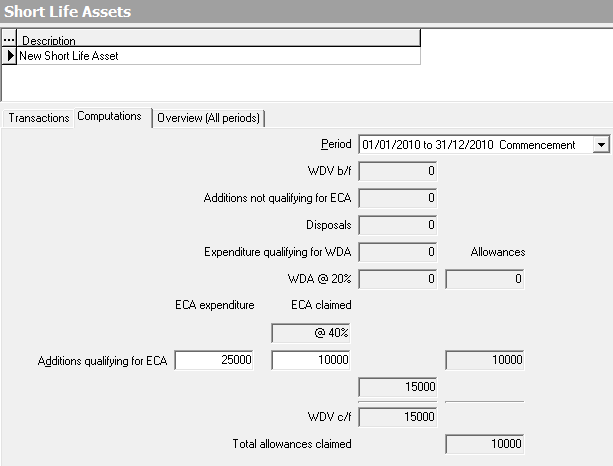

This window displays the computations that Business Tax has made in order to calculate the Written Down Value of the assets. Most of the boxes on this window are read-only.

Note: Boxes relating to FYA or ECA are only visible when a claim for these is made on the Transactions tab by choosing an applicable rate from the FYA/ECA% column.

Use the Period drop-down list to view the computations for a different period.

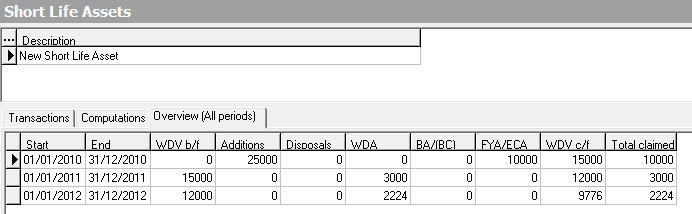

This tab provides an overview of the Asset Transactions for each period. For each accounting period, the tab shows the totals of the following:

- Written Down Value b/f

- Additions

- Disposals

- Written Down Allowances

- Balancing Adjustments/(BC)

- WDV c/f

- Total claimed

All the boxes in this window are read only. The values can only be amended by entering the relevant transactions in the Transactions tab.

How do I get here?

Capital Allowances > Plant and Machinery > Single Asset Pools > Private Use Assets

- Click the Ellipsis button

next to the Description label.

next to the Description label. - Choose Add from the pop-up menu. A new row appears on the grid.

- Click in the Description cell and start entering the details.

- Press the TAB key to move to the next cell.

- Click Save when you've finished entering transactions.

- Select the transaction you want to delete.

- Click the Ellipsis button

next to the Description label.

next to the Description label. - Choose Delete from the pop-up menu. A Confirm window appears.

- Click OK. The transaction is deleted.